Technology

👨🏿🚀TechCabal Daily – Yellow Visa

In partnership with Lire en Français اقرأ هذا باللغة العربية TGIF! Its Friday! We made it. How will you be spending your weekend? If youre yet to subscribe to our Francophone newsletter, please do. Also, if you know anyone who is looking to get smarter about tech innovation, policy, culture, and ...

TechCabal

published: Jun 20, 2025

TGIF!

It’s Friday! We made it.

How will you be spending your weekend?

If you’re yet to subscribe to our Francophone newsletter, please do. Also, if you know anyone who is looking to get smarter about tech innovation, policy, culture, and economy as it unfolds in Francophone Africa, please tell them to sign up to the newsletter.

Cryptocurrency

Visa and Yellow Card want businesses in emerging markets to use stablecoins

If you thought the stablecoin hype was dying down, we’ve got news for you: it’s not.

Visa has partnered with Yellow Card, a crypto company that has processed $6 billion in transactions (mostly in USDT and USDC), to bring stablecoin payments to emerging markets. Both companies are testing a new integration on Visa Direct that will allow businesses and individuals to send and receive stablecoins.

While Visa is no newcomer to experimenting with stablecoins, its latest move comes just weeks after Stripe made a big internet splash by launching stablecoin payments in 101 countries, including several markets in Africa.

Everybody is gung ho about stablecoins because they help businesses solve FX liquidity crunch. Stablecoins are digital versions of fiat money. They are digital tokens backed 1:1 by fiat reserves (like the US dollar), so they keep circulating as long as those reserves hold. That makes it easier and cheaper for businesses in cash-strapped markets to move money without waiting on slow, expensive bank rails.

Regulatory clarity is also making companies take a second look. Countries like Japan, the UK, and Brazil are laying down legal frameworks for stablecoins. The US also passed a recent bill to govern stablecoin issuance and oversight. With more corridors easing up on stablecoins, the legal clarity is giving traditional finance players room to move. What used to feel like crypto’s wild west now has rules, and with the nimbleness of stablecoins, businesses can expand their services faster.

With more traditional finance players committing to the script, stablecoins are starting to look like finance’s next infrastructure layer.

Save more on every NGN transaction with Fincra

Stop overpaying for NGN payments. Fincra’s fees are more affordable than other payment platforms for collections & payouts. The bigger the transaction, the more you save. Create a free account in 3 minutes and start saving today.

Ecommerce

Chpter expands to 11 African countries in Flutterwave deal

Chpter opens a new chapter for social commerce in Africa

Kenyan startup, Chpter, which helps businesses sell on chat apps like WhatsApp and Instagram, has expanded into 11 new African markets through a deal with fintech company Flutterwave. This expansion to new African markets including Ghana, Egypt, Uganda, and Rwanda, is building on the startup’s presence in Kenya, Nigeria, and South Africa.

Merchants in these countries will have access to Chpters social commerce infrastructure, enabling them to accept payments in local currencies or USD through mobile money, cards, and bank transfers, while Flutterwave will process and settle the transactions on the backend.

Why this matters: Africa’s commerce is moving into DMs. With the number of WhatsApp users in Africa projected to reach 135.44 million by 2029, e-commerce will no longer be about websites but conversations. Chpter is riding on that wave with 60% of inbound traffic coming from chat apps, and thousands of merchants signing on.

What’s new with AI: Chpter is going AI-first. It has rolled out AI sales and support agents, with 45% of all customer interactions already being handled by bots. Their goal is to push that figure to 80% as the tech improves. The company is also betting that good automation paired with localised pricing could make Software-as-a-Service (SaaS) finally work at scale across Africa. It recently launched Pluto, its WhatsApp API suite that allows developers and businesses to build full customer journeys on WhatsApp.

But will the AI-heavy, subscription-based model prove sticky in these new markets? Chpter is betting on infrastructure and earlier achieved momentum. Can it turn this momentum into staying power across 14 very different African markets?

Order physical Paga cards, spend with confidence.

Tired of declined payments? Avoid the side-eyes at the cash till with Paga’s physical prepaid card. Designed to give you control, security, and ease. Fund and spend with confidence. Get yours today!.

Internet

Nigeria teams up with China for direct-to-device (D2D) satellite connectivity

Nigeria takes one step ahead of Starlink by signing a deal with China’s Galaxy Space to bring faster, satellite-powered internet straight to your digital devices.

Here’s what happened: The National Space Research and Development Agency (NASRDA) has signed an MoU with China’s Galaxy Space to deploy Direct-to-Device (D2D) satellite connectivity across the country. This rollout is expected before the end of 2025 and promises to significantly improve internet access and connectivity in Nigeria, particularly in rural and underserved regions.

What is D2D anyway? Direct-to-Device (D2D) satellite connectivity skips traditional infrastructure altogether. Think of it like Starlink: iInstead of relying on traditional infrastructure like cell towers, it connects digital devices directly to low-orbit satellites flying overhead. That means even in network dead zones, your device can stay online, chatting, browsing, and transacting.

Why it matters: Until now, Elon Musk’s Starlink has dominated the conversation on fast internet connectivity. While Starlink has only hinted at its direct-to-cell rollout plans in Africa, there is no clear timeline in sight. Galaxy Space is moving fast, and Nigeria could be its continental springboard.

Starlink may have the hype, but Galaxy Space just got a head start. And if this competition leads to better, cheaper, faster internet, that’s a win for everyone on the ground.

Stay up to date with the latest Paystack news!

Subscribe to Paystack for a curated dose of product updates, insights, event invites and more. Subscribe here →

Insights

Funding Tracker

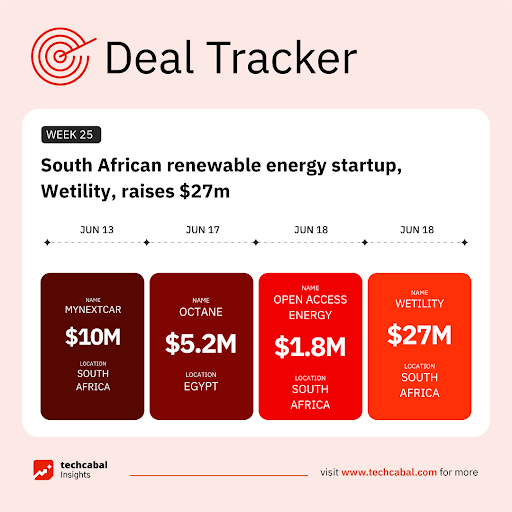

This week, South African solar-as-a-service provider Wetility secured $27m in a structured hybrid of senior and equity capital deal with alternative asset manager Jaltech. (June 18)

Here are other deals for the week:

- Egyptian fintech Octane secured $5.2m in a round that included Shorooq Partners, Algebra Ventures, and Elsewedy Capital Holding. (June 17)

- MyNextCar (MNC), a key fleet enabler for Bolt in South Africa, has raised $10m in its first institutional funding round. London-based Emso Asset Management led the investment with backing from Bolt, Assemble Capital, and E2 Investments. (June 13)

- South African startup Open Access Energy (OAE) closed a $1.8 million seed funding round with participation from E3 Capital, Equator VC, and Factor E Ventures. (June 18)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, what are the strategic exits reshaping Africa’s fintech future? Read here.

Introducing, The Naira Life Conference by Zikoko

This August, the Naira Life Con will bring together wealth builders, entrepreneurs, financial leaders, and everyday Nigerians to share their experiences with earning, managing, and spending money. Think: bold conversations, immersive workshops, and content tracks that hand you a playbook for building real wealth. Get early bird tickets now at 30% off only for a limited time.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $104,542 |

– 0.36% |

– 2.28% |

|

| $2,512 |

– 0.27% |

– 1.13% |

|

| $2.11 |

– 9.36% |

– 33.88% |

|

| $145.41 |

– 0.61% |

– 14.43% |

* Data as of 05.30 AM WAT, June 20, 2025.

Events

- The 2nd Edition of the Uganda Investor Summit is here!

Happening on June 19-20, 2025, the event will connect global investors with high-growth sectors, spotlighting innovation, partnerships, and investment-ready opportunities. Register here.

Happening on June 19-20, 2025, the event will connect global investors with high-growth sectors, spotlighting innovation, partnerships, and investment-ready opportunities. Register here. - Join the Africa Technology Expo (ATE) in Lagos on June 21, 2025. This year, ATE takes a bold step forward, spotlighting the future of African tech with a sharp focus on hardware, telecoms, software, and more, exploring the ideas shaping tomorrow. Grab your tickets.

- Join over 1,000 participants including ministers, key decision-makers, and CEOs at the 5th edition of the Cyber Africa Forum (CAF) on June 24–25 in Cotonou, Benin. To register, click this link.

Written by: Emmanuel Nwosu, Opeyemi Kareem, and Stephen Agwaibor

Edited by: Faith Omoniyi

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

Stay in the loop

Never miss out on the latest insights, trends, and stories from Cedi Life! Be the first to know when we publish new articles by subscribing to our alerts.