Technology

👨🏿🚀TechCabal Daily – Nigeria is coming for remote workers

In partnership with Lire en Français اقرأ هذا باللغة العربية Good morning. Electronic Arts , congrats on your $55 billion acquisition. Big news for you, no doubt. But gamers everywhere have just one request: whoever takes the reins, don’t mess with FIFA’s Ultimate Team grind. Some things are sac...

TechCabal

published: Sep 30, 2025

Good morning.

Electronic Arts (EA), congrats on your $55 billion acquisition.  Big news for you, no doubt. But gamers everywhere (us) have just one request: whoever takes the reins, don’t mess with FIFA’s Ultimate Team grind. Some things are sacred.

Big news for you, no doubt. But gamers everywhere (us) have just one request: whoever takes the reins, don’t mess with FIFA’s Ultimate Team grind. Some things are sacred.

Let’s get into it.

Regulation

Nigeria’s government wants to crack down on remote workers’ incomes

Fun’s over for Nigeria-based remote workers. Starting January 2026, Nigerians working for foreign companies—whether as developers, marketers, or in other roles—will be required to register with the tax authorities and file local tax returns.

And if these workers fail to register with the Nigeria Revenue Service (NRS)? The penalties pack a punch. The government will bite back with fines of up to ₦1 million ($672), three years in prison, or both. The revenue service plans to track real-time transaction data for payments to ensure compliance.

Why does this matter? Nigeria’s remote workers have mostly stayed outside the tax net. Now, a freelancer earning $2,000 a month pays about 23% in taxes, cutting into income they did not plan to lose.

Zoom out: Nigeria joins Kenya, South Africa, and Ghana in cracking down on remote workers earning foreign income. The government is now demanding a detailed accounting of every dollar earned overseas. This is part of Nigeria’s push to increase its tax-to-GDP ratio to 18% by 2027, and remote workers earning foreign currency are one of its main targets. The real question is whether these taxes will actually improve life for Nigerian workers in the long run.

eCommerce Without Borders: Get Paid Faster Worldwide

Whether you sell in Lagos or Nairobi, customers want local ways to pay. Let shoppers check out in their local currency, using cards, bank transfers, or mobile money. Set up seamless payments for your global online store with Fincra today.

Mobile Money

Kenya wants to cut fees on mobile money transactions

The Central Bank of Kenya (CBK) has decided that the cost of sending money on mobile money platforms is too high, and it wants to slash these fees. The average cost was $0.18 in 2024. As part of its 2025–2028 National Financial Inclusion Strategy, the CBK wants to drive the fees down to $0.078 by 2028.

Why are they doing this? Mobile money growth is stalling. While mobile money is already massive in Kenya—with operators processing $67.3 billion in 2024—growth has flatlined. The regulator blames the high costs of transfer fees for low uptake of other services beyond basic transfers and the exclusion of low-income users from the digital economy. It argues that high fees are choking innovation and limiting the next phase of financial inclusion.

This has happened before. In 2020, Kenya’s mobile money operators, including Safaricom’s M-PESA, waived transaction costs on all transfers under $7.73 (KES 1,000) to encourage e-payments adoption. But two years later, it returned the fees.

What does this reduction mean? Mobile money is the cash cow of telecom firms, with M-PESA contributing $1.2 billion in revenue for Safaricom in 2024. Cutting transaction fees could reduce that revenue. On the flip side, users get cheaper access to digital finance.

Zoom out: Cheap money transfers could make digital finance more accessible. But will this price slash actually pull low-income earners into the fold or simply chip away at the telecom operators’ golden goose?

Paga is in USA

Big news! Paga Group is now live in the United States, with digital banking services designed for Africa’s diaspora! Eligible users can send, pay, and bank in US Dollars & Naira, safe, regulated, and borderless. Learn more.

Telecoms

Telkom Kenya falls to fourth place after losing 40% of its customers

4 out of every 10 users left Telkom Kenya in one year. This significant crash now places the telecom company in fourth place among competitors like Safaricom and Airtel. Equitel, Equity Bank’s mobile operator running on Airtel’s infrastructure, now claims the third spot with 1.5 million subscribers, while Safaricom and Airtel maintain their dominance in the top two.

What happened? The collapse began in 2023 when American Tower Corporation (ATC) disconnected nearly 900 of Telkom’s masts over $55 million in unpaid lease fees, triggering a coverage crisis. Network quality declined, and customers flocked to competitors with more reliable service.

Why does this matter? Poor service drives customers away, shrinking revenue, making it harder to fix the network and pay debts. Falling to fourth place means Telkom is unlikely to raise capital or attract strategic investors for 4G/5G upgrades, leaving the telco with deteriorating infrastructure and no real, clear path to get its numbers and customers back.

Zoom out: Telkom still owns valuable assets, 4,000km of fiber and data centers, but recovery could be unlikely. Its situation mirrors Nigeria’s T2 (formerly 9mobile, formerly Etisalat), which defaulted on $1.2 billion in loans in 2017, fell from third to fourth place, and still hasn’t recovered its market position. Both cases show how quickly debt problems can trigger irreversible subscriber decline. The question is: how will Telkom bounce back?

Connect Paystack to the world’s best tools!

With the Paystack Integrations Directory, connect to 60+ powerful apps to streamline your business. Learn more here →

Fintech

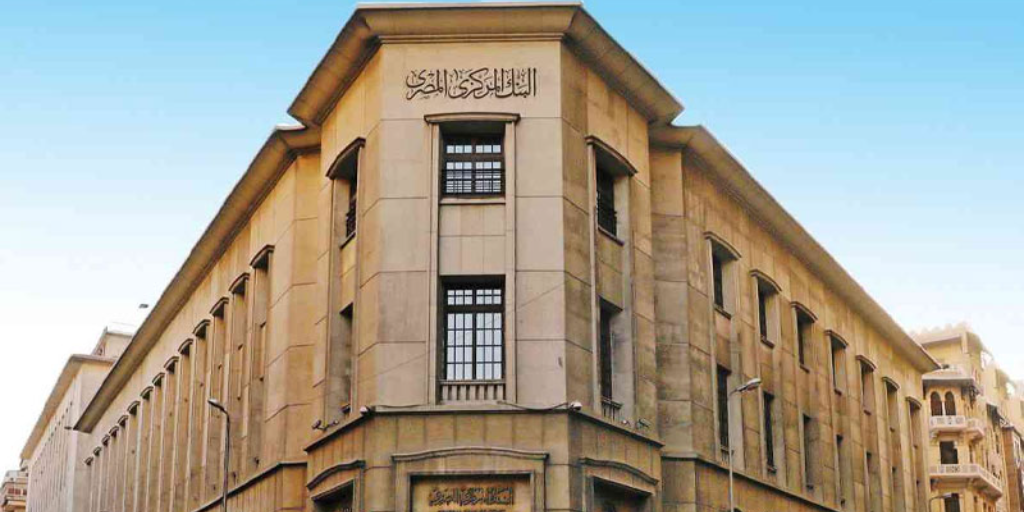

Egypt breaks remittance record

Egypt hit a remittance record. Money coming in from diaspora more than doubled in the last decade. The remittance figures reached $36.5 billion in fiscal year 2024/2025 compared to $17.1 billion in 2015/2016. July alone saw $3.8 billion in remittances, the highest monthly inflow recorded.

What could have pushed this growth? The Central Bank of Egypt (CBE)’s steady hand can take a part of the credit. The bank’s prudent monetary policy, which involved balancing interest rates and money markets over the years, kept FX stable and strengthened confidence in citizens in diaspora that their money wouldn’t vanish in exchange rate chaos.

Another factor is the rise of digital remittance payment rails. Fintechs and remittance startups have made it easier for cross-border payments to happen. More seamless transfer options mean more dollars flowing through formal payment channels.

What does this mean? This rise in remittance payments places Egypt on the radar for remittance startups. Players like LemFi are already eyeing this market to redirect some of those remittance flows on its rails. The market is too big to ignore, and it is still growing. Egypt should expect more fintechs on its borders, and local startups should brace up for competition because these newcomers are relentless. They are coming with technology and capital, and they won’t stop until they take a sizable share of the market.

COOL STUFF!

While most of us were busy unwinding on X or TikTok last weekend, this creator took time to build a smart stick that could make a difference. Using sensors and AI, the device detects obstacles in real-time and alerts blind users before they walk into danger. It’s the kind of practical assistive tech that could improve life for more than 26 million Africans living with visual impairment.

In a world obsessed with the next big AI software, it’s refreshing to see someone use technology to build something small, meaningful, and physical that directly improves accessibility.

Shout-out to Ugo.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $114,577 |

+ 2.05% |

+ 4.93% |

|

| $4,192 |

+ 1.72% |

– 6.92% |

|

| $2.88 |

+ 0.76% |

+ 1.25% |

|

| $210.58 |

+ 0.17% |

+ 3.03% |

* Data as of 06.00 AM WAT, September 30, 2025.

Read MoreStay in the loop

Never miss out on the latest insights, trends, and stories from Cedi Life! Be the first to know when we publish new articles by subscribing to our alerts.

Flash Sale: 25% Off Moonshot Tickets

Flash Sale: 25% Off Moonshot Tickets

Secure 25% off your Moonshot ticket now.

Secure 25% off your Moonshot ticket now.