Technology

👨🏿🚀TechCabal Daily – Food delivery is magic beans

In partnership with Lire en Français اقرأ هذا باللغة العربية TGIF! Africa’s tech ecosystem is alive with ambition, and Moonshot 2025 is catalysing it into unstoppable momentum. Our theme, “Building Momentum,” honors past builders and calls for doubling down on systems, capital, ...

TechCabal

published: Jun 27, 2025

TGIF!

Africa’s tech ecosystem is alive with ambition, and Moonshot 2025 is catalysing it into unstoppable momentum. Our theme, “Building Momentum,” honors past builders and calls for doubling down on systems, capital, policies, and partnerships.

Expect new formats, deeper conversations, and broader voices. This is where vision becomes action. If you’re building, funding, or enabling Africa’s innovation economy, join us October 15–16 in Lagos. Early Bird tickets are 20% off! Let’s build the future, faster, smarter, together.

Let’s dive in.

Food Delivery

Food delivery is magic beans

Ask any seasoned African tech expert and you’ll hear the standard verdict: food delivery drains investor dollars, an understandable stance as Africa’s digitally savvy youth population faces dwindling purchasing power.

Yet Foodpod by Subtext, a three-part report produced with Paystack, asks different questions and shows the sector already defying predictions of failure.

Between 2021 and 2024, Nigerians saw basic food prices double and their purchasing power halve, but more than ever embraced online orders; the segment recorded a spectacular 187 % compound annual growth rate. Chowdeck’s monthly orders rocketed to one billion, while Glovo clocked ₦72 billion ($46.5 million) in vendor sales. Growth now extends beyond aggregators to a buzzing lattice of logistics firms, cloud kitchens and quick-service restaurants.

This exponential growth isn’t limited to aggregators; a bustling ecosystem of logistics providers, cloud kitchens, and quick-service restaurants is also thriving.

Osarumen Osamuyi, author of Foodpod, argues that we shouldn’t be too quick to dismiss the sector’s potential. He argues that the investment of previous players were not an absolute loss; they cultivated new market behaviours that have laid the groundwork for current growth, particularly in Lagos and some Tier 2 cities.

The question of whether a successful business can be built selling convenience where money is scarcer than time may be outdated. Instead, Osamuyi proposes: “Perhaps the question is not whether you can build a large business doing delivery; it is about what you do once you’ve built one.”

Foodpod likens food delivery to “magic beans” in the fabled Jack and the Beanstalk, where a boy trades his family’s only asset for a bag of beans that sprout a ladder to unexpected riches overnight. Likewise, the sector may not look lucrative at first but can reward those who master it. Platforms already stretch into non-food retail, courier services and advertising; Chowdeck’s recent acquisition of Mira pushes it into restaurant inventory management. And this, Foodpod insists, is only the beginning.

If this optimistic perspective about the sector sounds interesting to you; you can read Osamuyi’s first part of the three Foodpod reports and catch up on the rest later here.

Save more on every NGN transaction with Fincra

Stop overpaying for NGN payments. Fincra’s fees are more affordable than other payment platforms for collections & payouts. The bigger the transaction, the more you save. Create a free account in 3 minutes and start saving today.

Banking

Ethiopia to allow foreign banks for the first time in 5 decades

For over 50 years, Ethiopia kept foreign banks out. The official reason? Protect the local economy. But beneath the surface, the “why” was always bigger than nationalism. It was about control. After the 1974 nationalisation of banks under the Derg regime, Ethiopia sealed off its financial sector to foreign entities, even long after the Derg regime ended.

Now, in a sharp turn, the country is inviting foreign banks and investors. Why?

The answer isn’t just in the press releases. Ethiopia is grappling with economic pressures. Since 2018, foreign direct investment has collapsed, driven by economic mismanagement and the civil war in Tigray. In July 2024, under a new structural adjustment programme by the International Monetary Fund (IMF), the government floated its local currency, which made it fall 30% against the US Dollar, triggering a rise in poverty. Add this to the ongoing talks of restructuring its $8.4 billion debt, and the urgency is clear.

Foreign banks like Kenya’s KCB and South Africa’s Standard Bank have long been eyeing the market. Now, with licences capped at five over the next five years, competition will be fierce. But even that is a big leap in a country once allergic to foreign financial control.

How will all this play out? Your guess is as good as mine. The headlines speak of reform. But the subtext? It reeks of desperation.

Drive your business forward with Doroki

Whether you are a retail store, restaurant, pharmacy, supermarket, salon or spa, Doroki helps simplify your operations so you can focus on what matters most: your customers and your growth. Manage your business smarter, start here.

Policy

South Africa’s President backs BEE reforms for ICT sector

President Cyril Ramaphosa has thrown his weight behind a plan to shake up how South Africa applies Black Economic Empowerment (BEE) rules in telecoms. The play is to allow global tech players like Starlink into the market, without forcing them to give up 30% local ownership.

Instead of giving up 30% of ownership to the locals, they’d contribute through the Equity Equivalent Investment Programme (EEIP). Starlink has committed R500 million ($28 million) to this local investment.

What is the EEIP? It allows multinationals that can’t meet the 30% local ownership requirement to invest in skills, enterprise development, or infrastructure instead. It’s a model already used in other South African industries like automotive and pharmaceuticals. This policy shift was proposed by the communications minister, Solly Malatsi, in May 2025.

The policy was proposed two days after Ramaphosa met with US President Donald Trump in Washington. Malatsi has denied claims that the EEIP policy was designed to favour Starlink, but critics in Parliament say the timing raises questions.

Despite the controversy, Ramaphosa told Parliament that the move aligns with existing laws and supports South Africa’s transformation agenda. Yet, Parliament isn’t fully on board, and the Independent Communications Authority of South Africa (ICASA), the country’s communications regulator that issues licences, hasn’t changed its rules yet.

But with Ramaphosa’s stamp of approval, this might mean we could see South Africa move forward with this alternative policy to the BEE rules. If, and when this happens, it blows the door wide open for Starlink and other foreign telecom players.

Turn your hustle into an online business with Paystack!

Anyone can sell online. With Paystack Storefront, you can create a sleek online store, share your link, and accept payments. No code needed. Get started here →

Insights

Funding Tracker

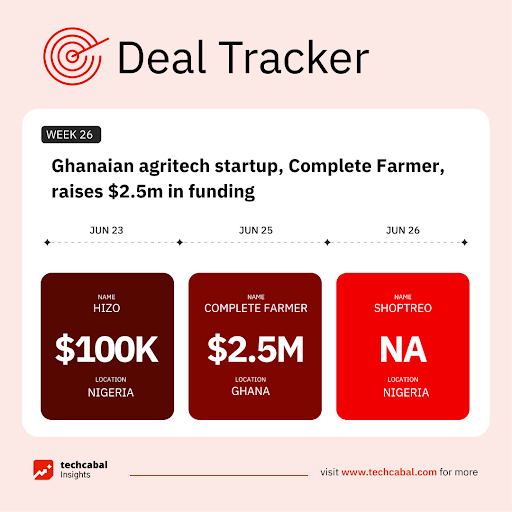

This week, Complete Farmer, a Ghanaian agritech company, announced $2.5 million in fresh financing from the EU’s AgriFI initiative. (June 25)

Here are other deals for the week:

- Nigerian fintech startup Hizo raised a $100,000 “friends and family” seed round of funding. (June 23)

- Nigerian e-commerce startup Shoptreo secured an undisclosed round of financing from Rebel Seed Capital. (June 26)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go,what are the strategic exits reshaping Africa’s fintech future? Read here.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $107,448 |

– 0.36% |

– 1.32% |

|

| $2,452 |

– 1.29% |

– 7.26% |

|

| $2.10 |

– 3.98% |

– 8.86% |

|

| $141.45 |

– 2.81% |

– 19.28% |

* Data as of 05.45 AM WAT, June 27, 2025.

Opportunities

- Applications are now open for the 2025 FATE Institute Fellowship, a two-year, part-time and virtual programme for experienced Nigerian professionals passionate about entrepreneurship and policy reform. The fellowship is open to candidates with at least 10 years of relevant experience and a completed or ongoing Master’s or PhD in fields like Economics, Law, or Political Science. Fellows will work remotely, contribute to research on Nigeria’s entrepreneurship ecosystem, engage with policymakers, and take part in virtual policy discussions, without needing to leave their current roles. Apply by July 25.

- What does it really take to build impactful businesses that lasts in Africa, beyond just chasing revenue? At a recent engagement, a group of remarkable African founders and leaders opened up about the messy middle: the pivots, the failures, and the breakthroughs that helped them scale with purpose. We’ve captured their stories and insights in a report that’s honest, practical, and full of lessons you won’t find on social media. You can dive into it now. And if you’re serious about building for scale, you’ll want to be in the room at Moonshot 2025 in Lagos where these calibre leaders will be sharing even more. Tickets are live, get yours here. Let’s build the future, together.

- GreenTec Capital is offering startups in South Africa, Nigeria, and Ghana €100,000 in non-dilutive, non-repayable funding through the develoPPP Ventures programme, with a potential top-up of €100,000+ within 12 months. Eligible startups must be revenue-generating, digitally driven, and have raised at least €100,000 recently or be close to doing so. These startups must have also raised less than €2 million. Applications close Monday, June 30 at 23:59 CET. Apply here.

Written by: Ngozi Chukwu, Opeyemi Kareem, and Stephen Agwaibor

Edited by: Emmanuel Nwosu

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

Stay in the loop

Never miss out on the latest insights, trends, and stories from Cedi Life! Be the first to know when we publish new articles by subscribing to our alerts.