Technology

Predatory loan apps are stealing data: Here’s how to protect yourself

Digital lending has made borrowing money easy, especially if you need quick cash. However, behind this convenience lies a growing threat: predatory loan apps are more interested in stealing your personal information than helping you. The main challenge is distinguishing between legitimate financi...

TechCabal

published: Oct 08, 2025

Digital lending has made borrowing money easy, especially if you need quick cash. However, behind this convenience lies a growing threat: predatory loan apps are more interested in stealing your personal information than helping you.

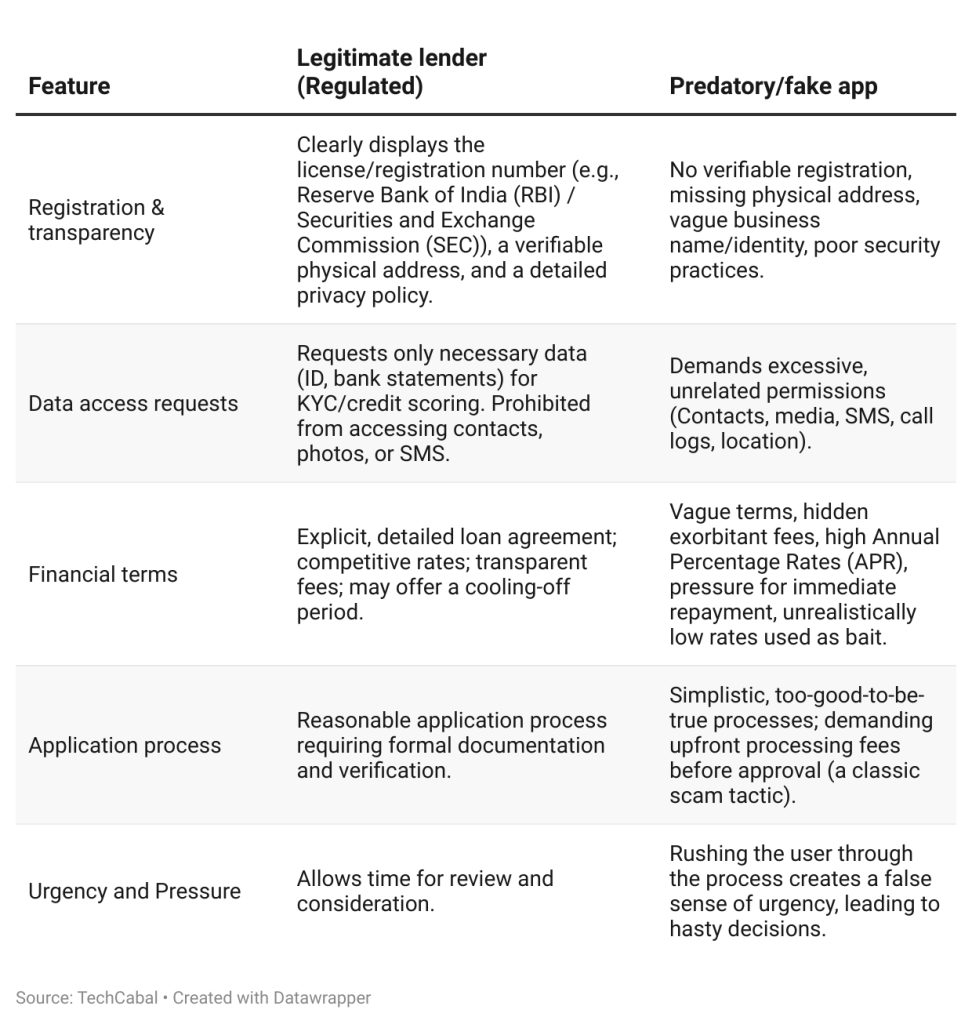

The main challenge is distinguishing between legitimate financial platforms and fraudulent apps designed to harvest your data.

How predatory loan apps work

Many fake lending apps promise fast, stress-free loans. But once you install them, they demand permissions that have nothing to do with giving you credit. Legitimate lenders typically request basic information, such as your ID, income, and bank details, to verify your creditworthiness and comply with regulations.

Predatory apps go much further. They request access to your contacts, messages, photos, call history, and calendar. This is a red flag. No genuine lender needs that level of access to give you a loan.

Data theft turned into extortion

These apps don’t collect your data for credit checks; they collect it to use against you. Once you give permission, they immediately pull sensitive information from your phone. If you fall behind on payments, they use your contacts to threaten, shame, and harass you into paying.

Some borrowers have received intimidating calls and messages. Others have seen personal photos altered and shared with family, friends, or colleagues. In many cases, loan collectors even create group chats to publicly expose borrowers.

The money you borrow is just the bait. Your personal data is the real target. Instead of focusing on financial recovery, these operators rely on fear and embarrassment to collect debts. In some tragic cases, victims have taken their lives because of the intense harassment.

Why data protection matters

Traditional fraud focuses on stealing money or identities. Predatory loan apps take it a step further by damaging your reputation and personal relationships. That’s why the best way to protect yourself isn’t just about reading loan terms. It’s about controlling the data you share and limiting app permissions from the start.

How to spot dangerous loan apps before you download

The easiest way to protect your data is to take action before installing any loan app. Many people get trapped because they rush to download without checking basic details. A quick background check can save you from data theft, fraud, or harassment later on.

1. Check if the lender is legit

Begin by verifying that the company is registered with the relevant financial regulator in your country. For example, in India, lenders must be listed with the Reserve Bank. In the Philippines, registration with the Securities and Exchange Commission is required. You can easily verify this through official government websites.

Next, check their website and contact information. A legitimate company will have a clear physical address, working phone numbers, and customer support you can actually reach. If you can’t find a verifiable address or the contact details look shady, treat it as a red flag.

Their privacy policy should also be easily accessible and written in plain language. Trusted lenders explain exactly what data they collect and how they protect it. Fake apps often use vague terms to trick you into giving away more information than necessary.

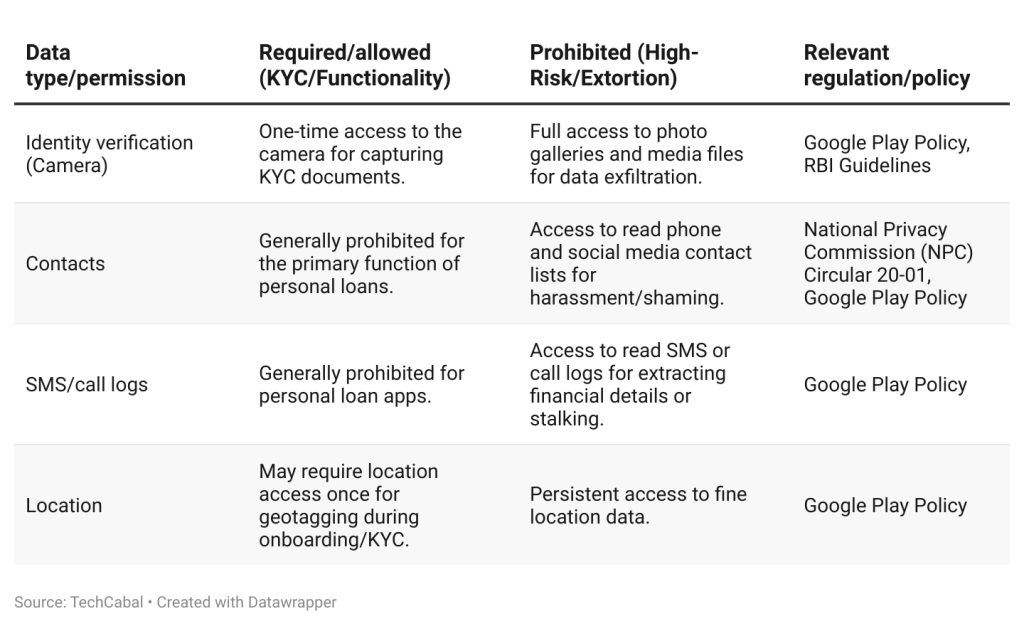

2. Watch for data-hungry permissions

One of the most evident warning signs is how the app handles permissions. According to official store policies, loan apps are not allowed to access your contacts, photos, or location. If an app requests these, it’s likely planning to misuse your data.

Another red flag is when they ask you to pay upfront fees, such as “processing” or “insurance,” before approving your loan. This is a classic scam tactic that results in an instant loss of money. Even if the loan is never approved, the personal details you’ve shared can be used later for identity theft.

3. Read reviews and stick to trusted sources

Before downloading, carefully review the app’s reviews. If many users complain about high charges, harassment, or unclear terms, stay away. Also, never download from unverified links or third-party stores, regardless of how convincing they appear. Official app stores provide a safer environment and offer a way to report suspicious behaviour.

Red flags checklist: Identifying predatory digital loan apps

Take control of app permissions to protect your data

Even if a loan app looks legitimate, the best way to protect your personal information is by controlling what the app can access on your phone. Most predatory apps rely on careless permission approvals to steal sensitive data. By managing permissions properly, you can block them at the source.

1. Global rules are now on your side

Major platforms, such as Google, have established stringent guidelines for loan apps. Personal loan apps on the Play Store are not allowed to request access to contacts, photos, storage, location, or phone numbers. These are the exact permissions scammers use to shame and threaten borrowers.

Many regulators have also stepped in. For example, India’s Reserve Bank bans lenders from accessing users’ files or contact lists. The Philippines’ privacy agency has issued similar rules. These policies provide you with the legal backing to deny any request for unnecessary access.

2. Review and revoke app permissions regularly

People often give apps too many permissions without thinking. Later, they forget what they allowed. A quick monthly check helps you keep control.

For Android users:

- Open Settings, then go to Apps.

- Pick the loan app, tap Permissions, and switch off anything that isn’t needed.

- For a more comprehensive check, use Permission Manager under Privacy to see which apps can access sensitive information, such as contacts or photos. Remove permissions that don’t make sense.

For iPhone users:

- Open Settings → Privacy & Security.

- Select a data category, such as Contacts or Photos, to view all apps with access. Toggle off anything suspicious.

- You can also enable App Privacy Report to see which apps are using your data most often.

3. Make permission checks a habit

Review your app permissions at least once a month to ensure they are updated. Some apps quietly gain more access through updates, so staying alert protects you from surprises. When possible, provide temporary access for one-time actions instead of granting permanent access.

This simple habit, backed by platform rules and privacy laws, provides you with strong protection against loan apps that misuse your data.

Data permission guide: Allowed vs. prohibited access for loan apps

Advanced protection: How to isolate loan apps and limit data exposure

If you rely on loan apps but want maximum privacy, isolation techniques give you an extra layer of defence. The idea is simple: keep the app in a separate, controlled space so it can’t touch your personal contacts, photos, or messages. Even if the app turns out to be predatory, the data it can access will be limited and harmless.

1. Use guest mode or multiple users on Android

Most Android phones have a Guest Mode or Multiple Users feature. This lets you create a temporary space on your device that doesn’t contain your personal information.

Here’s how to set it up:

- Go to Settings → System → Multiple users.

- Tap “Add user” or “Guest” to create a separate profile.

- Install the loan app inside this profile. It will only see what’s in that space, not your primary contacts or files.

- When you’re done, switch back to your main profile and delete the guest session to wipe any leftover data.

This simple step isolates the loan app completely.

2. Try secure folders or dual apps

Some Android phones, such as Samsung devices, feature a Secure Folder or Private Mode, which creates an encrypted space on the device. You can install sensitive apps there without giving them access to your primary data.

Another option is to use Dual Apps or App Cloners, which create a separate copy of the app. This copy runs in its own space, keeping your primary data safe. If a loan app attempts to retrieve information, it will only find the limited data within that isolated environment.

3. Use a secondary phone number

Predatory lenders often harass borrowers through their primary phone numbers. To protect yourself, use a secondary number, such as one from a VoIP service like Google Voice or a second SIM card, for all loan-related registrations. This creates a buffer between your personal life and the loan app.

4. Keep a separate device for financial apps

For the highest level of protection, use an old smartphone as a dedicated financial device. Remove personal apps, contacts, and photos, and use this device only for banking or loan transactions. Even if a loan app misbehaves, it’s contained in that device and can’t reach your personal information.

Your rights and how to respond when a loan app crosses the line

Protecting your personal data isn’t just about using secure phones and smart settings. Strong consumer protection laws also give you powerful tools to fight back when lenders misuse your data or try to intimidate you. Knowing these rights and how to use them can make a big difference.

Your legal rights when using loan apps

Regulations in many countries require lenders to be transparent about the data they collect and the reasons behind it. Before any data is gathered, you must give direct and specific consent. This means you get to decide precisely what information you’re willing to share. Lenders can only collect data that’s necessary for purposes such as credit checks or ID verification. Anything extra is against the rules.

Some countries also require personal data to be stored locally. In India, for example, lenders are required to delete any personal information stored on foreign servers within 24 hours. They’re also not allowed to collect biometric data such as fingerprints or facial scans unless the law permits it. Lenders must provide privacy notices that clearly explain how they collect, use, and protect your personal information.

You also have control over your data after sharing it:

- You can opt out or revoke your consent at any time if you change your mind.

- Request data deletion if you no longer want a lender to keep your information (with some legal exceptions).

- Correct inaccurate information if something on your record is wrong.

- Use the cooling-off period if your country offers it. This gives you time to cancel a loan without penalties by repaying the principal and interest owed. It’s a safety net if you realise the lender is demanding too much access or using shady tactics.

What to do if a loan app starts harassing you

If a lender begins threatening, shaming, or misusing your information, you need a clear plan. Start by collecting evidence. Save screenshots of abusive messages, keep records of repeated calls, and note every instance of privacy violations. This information is essential if you need to involve regulators or law enforcement.

Next, report to the lender. File complaints with your local privacy or financial regulator, not just the lender. Framing your complaint as a privacy violation gives regulators more substantial legal grounds to act. You should also alert Google Play or the Apple App Store, which have removed hundreds of predatory apps after receiving evidence.

For regulated lenders, contact their official grievance officer. Document every step. If your identity has been stolen, follow national reporting procedures to protect yourself from further harm.

Final thoughts

The most significant warning sign is what a loan app asks for. If an app wants access to your contacts, photos, messages, or location, that’s a red flag. Deny the request immediately.

Before installing any loan app, check that the lender is registered with the proper financial authorities. Review the privacy policy for clear explanations about how your data will be used. If you’ve already installed the app, use your phone’s permission manager to block risky data access.

If things go wrong, don’t stay silent. Collect evidence, report the violation, and use your legal rights to protect yourself. By doing this, you not only defend your privacy but also help regulators remove bad actors from the system.

Read More