Business

Here Is Proof We Are Watching A Historic Economic Boom

To investors,It seemed like everyone was predicting an economic collapse just a few weeks ago. There was talk of recessions, depressions, and empty shelves on every news channel. The academics and economists were relevant for two seconds because they brought out a bunch of misplaced theories on w...

The Pomp Letter

published: Aug 30, 2025

To investors,

It seemed like everyone was predicting an economic collapse just a few weeks ago. There was talk of recessions, depressions, and empty shelves on every news channel. The academics and economists were relevant for two seconds because they brought out a bunch of misplaced theories on why the new economic policies being implemented were guaranteed to bring financial pain to Americans.

They were all wrong.

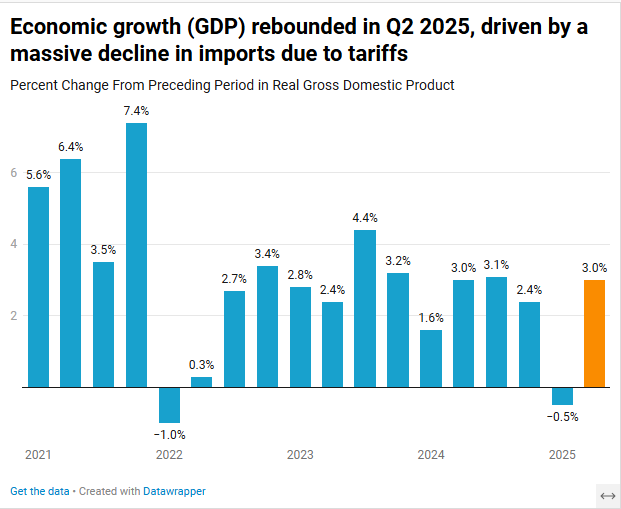

The United States economy is experiencing a historic economic boom. We got Q2 GDP numbers this morning and they blew away expectations. Instead of the forecasted 2.4% GDP growth number, the official measurement came in at 3%.

Just an insane outperformance for the economy. The economists were so wrong that you have to wonder how any of them have jobs left after a blunder like this.

So what exactly is driving this economic boom in America? Navy Federal’s Chief Economist Heather Long writes:

“The key drivers were: 1) A massive decline in imports after the April "Liberation Day" tariffs. -35.3% (!) for goods in Q2 2) Consumption up 1.4% (vs. just 0.5% in Q1)

Notable: Business investment declined in Q2, underscoring how nervous firms are to do much hiring or spending in uncertain times.”

And remember this positive economic surprise comes at a time when we are already experiencing a very bullish macro backdrop. Adam Kobeissi explains “the US economy is hot: We have now seen 63 months of US economic expansion, the 7th longest business cycle since 1854….By comparison, the longest period without a recession was between 2008 and 2020, at ~125 months. Since the 1980s, all economic cycle have lasted well above the historical average. Unconventional monetary policies and historically large budget deficits appear to be extending business cycles.”

So this is a great reminder that we are living through different times. The market has structurally been changed by the central bank’s willingness to print money, artificially suppress interest rates, and ultimately debase the currency. That decision is a structural tailwind for the economy and asset prices overall.

And here is the best part — Wall Street financial firms were predicting doom and gloom back in April. Retail investors were too busy ignoring the noise and buying the dip. In hindsight, the retail investors look like geniuses because they participated in one of the most historic market recoveries ever experienced by American investors.

Whether you liked tariffs or not, you must update your mental model. The economic policies are working. We are seeing significant economic growth, no sky-high inflation, and an unemployment rate that refuses to sound any alarm bells.

The big question now is can we continue the bull run for months to come? I believe so. But we are all going to find out together.

Hope you have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

eToro CEO Yoni Assia Explains Where Bitcoin Is Going and How His Company Will Dominate In America

Yoni Assia is the Founder & CEO of eToro, the world’s leading social investment network.

In this conversation we talk about why Yoni was buying bitcoin when it was real cheap in 2011, the rise to bitcoin being over 100k in price, why he thinks it’s still early, tokenization, how he thinks about being a public company CEO today, and what to expect moving forward.

Enjoy!

Podcast Sponsors

Figure – Lowest industry interest rates at 9.9% at 50% LTV! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.

Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Polkadot - is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.