Business

Assets Are Going Higher Because Trust Is Falling

To investors,Citadel’s Ken Griffin dropped a harsh truth in an interview with Bloomberg yesterday:“We’re seeing substantial asset inflation away from the dollar as people are looking for ways to effectively de-dollarize, or de-risk their portfolios vis-a-vis US sovereign risk.&#...

The Pomp Letter

published: Oct 07, 2025

To investors,

Citadel’s Ken Griffin dropped a harsh truth in an interview with Bloomberg yesterday:

“We’re seeing substantial asset inflation away from the dollar as people are looking for ways to effectively de-dollarize, or de-risk their portfolios vis-a-vis US sovereign risk.”

It is not every day that you see one of the world’s best investors say people are de-dollarizing their portfolio. Why would they want to de-dollarize? Goldman Sachs says the story is simple:

“Trump said America can “grow its way out of debt.” What it really means is debasement. Shutdowns highlight the erosion of trust in U.S. institutions — Bitcoin is the pressure valve. That’s not bearish S&P, it’s bearish dollar.”

Those are the magic words — erosion of trust in US institutions. People don’t trust the government. They don’t trust the news. And they definitely don’t trust the central bank. Why should they? Those three organizations have proven to be untrustworthy over the last decade.

One of my favorite Satoshi Nakamoto quotes is “The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

Ain’t that the truth. Satoshi knew the problem earlier than most.

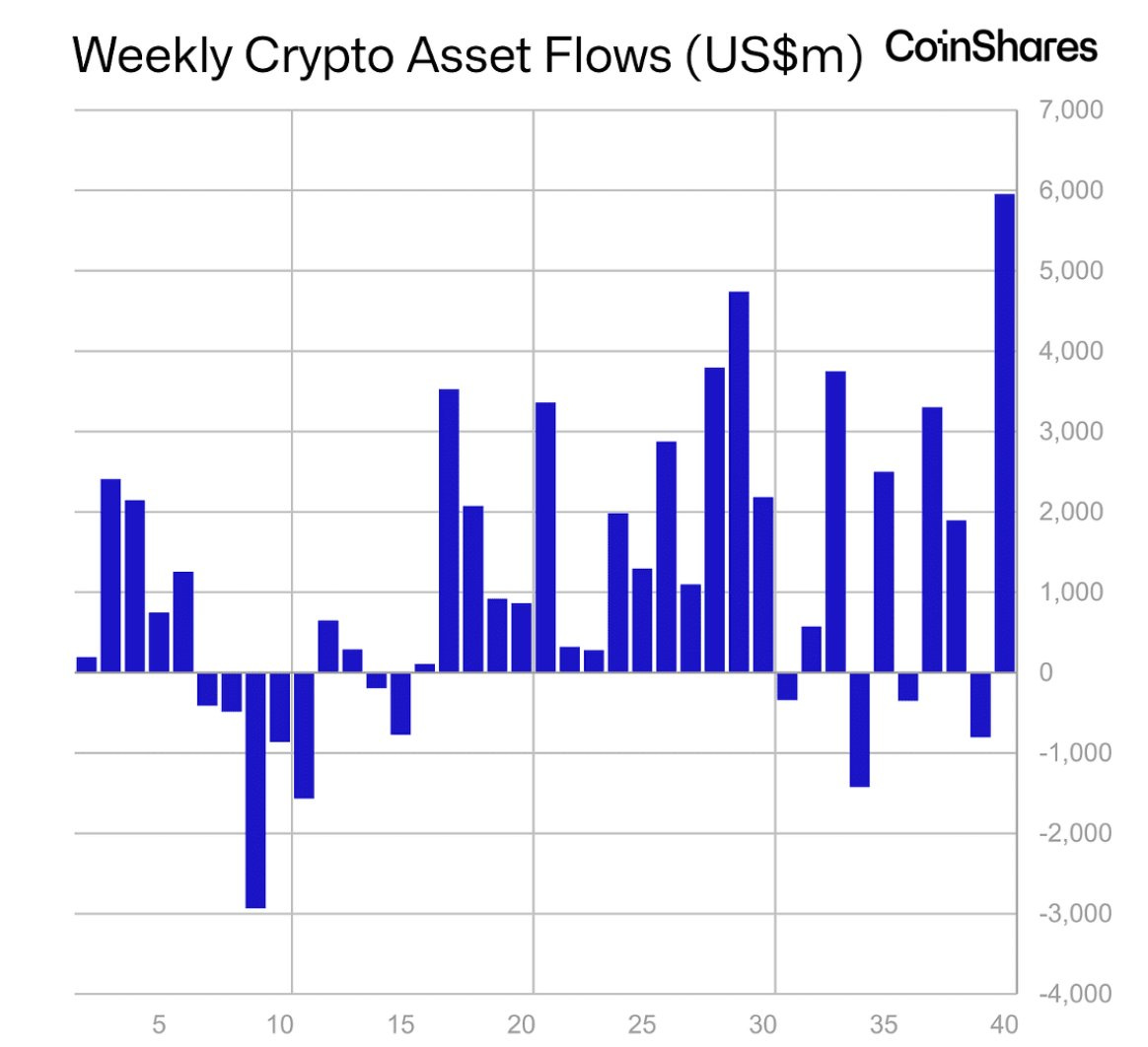

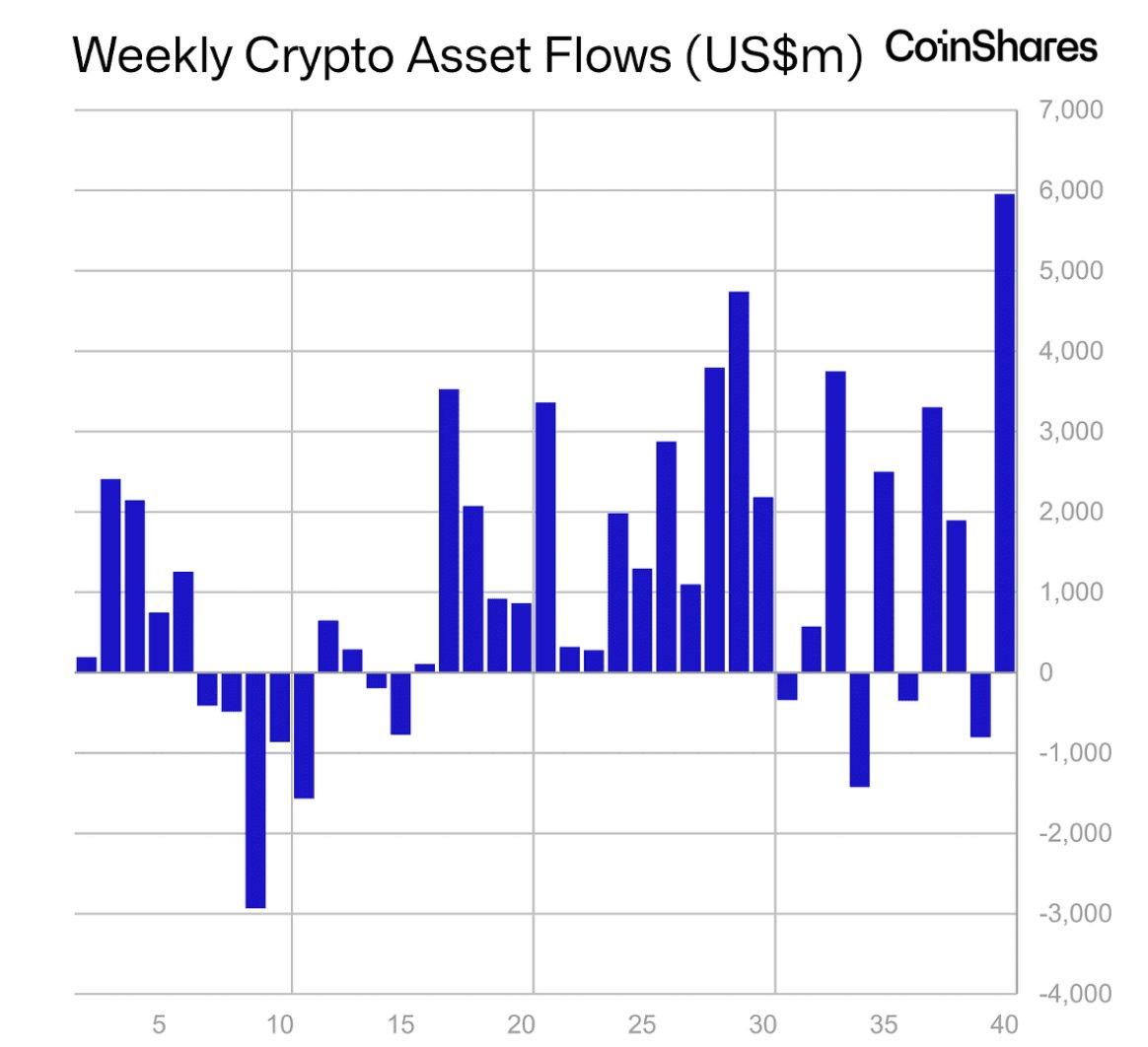

We are now seeing large amounts of capital flow to safety from this breach in trust. The crypto market saw $6 billion of inflows last week, which is an all-time high.

How should we think about these inflows? Should we assume this is speculation from investors looking to capture a quick profit? Or is there something much bigger at play?

End Game Macro says “this $6 billion inflow into crypto is a warning signal. Big money is moving because confidence in the global financial system is starting to fray. Historically, surges like this have appeared when investors begin losing faith in traditional credit markets. What makes this moment different is the context: global growth is slowing, debt loads are exploding, and the risk of a major credit event, something breaking in the bond or banking system is rising fast.”

Confidence is starting to fray. Trust is eroding.

This leaves citizens with a simple choice…stay trapped in the existing system and suffer whatever consequences come from the undisciplined decisions of leadership or take your assets and move them into a parallel system that was purpose-built to mitigate these disastrous policies.

That is the choice in front of investors — stay and suffer or leave and prosper.

It doesn’t seem like a hard choice to me. But here is the beautiful part about capitalism, everyone is financially incentivized to move to where their money will be treated best. First it was the individuals. Then we saw the small businesses and private companies. Next it was the public companies, which were followed by the large financial institutions. Eventually we will see the central banks and nation states.

Every dollar, every unit of economic value. It is all going to move into the new system and new assets. Some of the adoption will happen by true flight from the old system into the new system. Some of the adoption will happen by bringing the new assets into the legacy system via existing wrappers.

Regardless of how it happens, it could not be more clear that the transition is underway. The next decade will be defined by this trend. I implore you not to ignore it.

Hope everyone has a great day. I’ll talk to you tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Former Chairman of the House Financial Services Committee On Bitcoin

Jeb Hensarling is the former Chairman of the House Financial Services Committee and one of the most influential voices in economic policy during the 2008 financial crisis. He has also joined ProCap BTC as a Senior Advisor.

In this conversation, we talk about how Jeb pushed back against the bank bailouts, how those same issues led to the rise of bitcoin, his views on bitcoin, stablecoins, the broader crypto industry, and how technology and innovation are reshaping the financial system today.

Enjoy!

Podcast Sponsors

Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs

Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.

Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Polkadot - is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.